Home > African Marke > Tanzania

Time: Apr 25, 2016

General Information

As East Africa’s most populous country, the United Republic of Tanzania (URT) has identified many economic and social development challenges as national priorities. However, the growth has not translated into a substantially improved quality of life for most Tanzanians: during the past ten years, the annual population growth rate of 2.7% increased the absolute number of Tanzanians living in poverty by more than 1 million. Without significant improvements in governance, health, and healthcare systems, Tanzania faces the risk of overwhelming an already-fragile social service system and eroding future economic gains[1]. 19% of the total population in Tanzania has some kind of health insurance coverage, most of which are however inefficiently managed.

Tanzania imports about 70% of the national drug requirement. Due to currently low purchasing power, generic drugs comprise the majority of Tanzania’s pharmaceuticals market[2]. The pharmaceutical sector in Tanzania consists of 8 manufacturing industries all producing generic pharmaceutical products using imported active pharmaceutical ingredients (APIs). Most of the APIs are imported from India and China. Local pharmaceutical production in Tanzania takes place at the secondary level, with some tertiary level activities also undertaken.

Tanzania’s health system is complex and works in an environment of very limited financial and human resources. The ongoing process of Decentralization by Devolution (D by D) adds a layer of complexity that stretches the managerial ability of staff to coordinate across different ministries and fulfill their roles within the Ministry of Health and Social Welfare (MOHSW) and Prime Minister’s Office-Regional Administration and Local Government (PMO-RALG) structures[3].

Privatization stems from the neo-liberal ideology that focuses on market efficiency, accountability, alternative financing of state/public goods and services from the private sector, and end-user contributions through cost-sharing (e.g. user fees). However, despite a relatively well-developed policy environment for public-private collaboration in health, the process and methods for effectively engaging with the private sector and setting up public-private partnerships are not well known. This has significantly limited actual implementation of public-private collaboration within the health system[4].

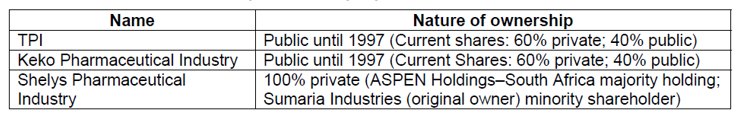

Table:Nature of ownership of the sample pharmaceutical industries

Health is not unified within the country and therefore the Mainland and Zanzibar each have their own National Health Policy. The Mainland implements its third Health Sector Strategic Plan (HSSP III, 2009 – 2015), which was developed in line with the goals of the National Strategy for Growth and Poverty Reduction (MKUKUTA), the National Health Policy 2007, and the MDGs. Zanzibar’s Health Sector Reform Strategic Plan (ZHSRSP II), based on the Zanzibar Strategy for Growth and the Reduction of Poverty, goes through 2011. Collectively, these documents are referred to as the National Health Plans, recognizing the improvement of people’s quality of life as essential to their ability to participate fully in their country’s productive processes, and thus placing the health sector as a government priority[5].

[1] Tanzania Global Health Initiative Strategy 2010 -2015, September 19, 2011, p.6.

[2] http://medical.wesrch.com/paper-details/press-paper-ME1XXF000YIAF-pharmaceuticals-and-healthcare-market-in-tanzania-market-dynamics-forecast-to-2014

[3] http://medical.wesrch.com/paper-details/press-paper-ME1XXF000YIAF-pharmaceuticals-and-healthcare-market-in-tanzania-market-dynamics-forecast-to-2014.

[4] https://www.wbginvestmentclimate.org/advisory-services/health/assessment-helps-tanzania-leverage-private-sector-resources.cfm

[5] Tanzania Global Health Initiative Strategy 2010 -2015, p.7.